02-24-2026: Bright Horizons Family Solutions Inc. (BFAM): Parents Struggle for Childrens' Future Education & Opportunity In Weak Economy

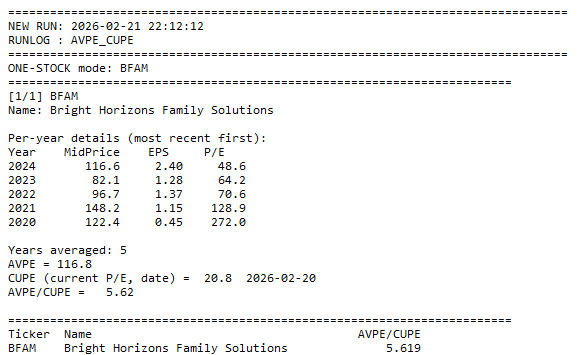

We normally put the following section later in our article but it was an outstanding feature that drew our attention to the company. Previously, BFAM was way down on the list of AVPE/CUPE candidates, but a recent strong earnings report boosted it near the top of all companies. As far as we could tell, analysts have overlooked this and many are still rating the company as a "sell" (depending upon your source for analysts). The more alert analysts were quick to catch this as an possibly "overlooked" stock with a lot of potential. The chart certainly did not reflect this until very recently. This is a large worldwide company with diversified locations and appears stable to us.

Description of Company |

▓ Company & Business Overview Bright Horizons Family Solutions, Inc. operates early-education and childcare facilities, backup care, and educational advisory services in the U.S. and internationally. Its business is tied to employment, workforce benefits, and demographic trends in childcare demand. ▓ Financial Performance 2025 results showed growth: Revenue ~ $2.9 B (+9% YoY) and net income ~ $193 M (+38%) reflecting operational improvement. Earnings per share exceeded expectations and revenue topped estimates consistently. Operating cash flow remains solid, with continued cash generation. Profitability & margins: Net profit margin modest (~7%), reflecting capital intensity. Return on assets and other efficiency metrics show moderate profitability relative to peers. ▓ Market & Valuation Valuation levels: Current trailing and forward P/E ratios are moderate (~19–22x trailing). Some valuation models (DCF) suggest significant upside (~50%+) vs current prices, while others show potential overvaluation risk depending on assumptions. Analyst expectations: Many analysts expect EPS and revenue growth over the coming year (~15–20%). Consensus price targets generally point to upside over current trading levels, though estimates vary. Market performance: Shares have underperformed major indexes recently and are well below prior highs, reflecting volatility and investor caution. ▓ Bullish Factors Growth Drivers Demand for childcare and workforce-linked services appears resilient and tied to broader employment trends. Backup care and educational advisory segments show above-average growth potential. Solid renewal rates with corporate clients suggests recurring revenue stability. Valuation Support Some valuation frameworks and analyst targets imply room for upside if growth materializes. ▓ Risks & Challenges Economic Sensitivity Consumer/business spending on discretionary services can be volatile, especially in slower economic periods. Profit & Cash Generation Profit margins and free cash flow are moderate, not exceptionally high relative to peers. Valuation Variability Mixed signals from valuation models — some suggest the stock may be fairly valued or expensive at current prices. Market Sentiment Recent stock weakness and analyst caution highlight short-term headwinds. ▓ Investment Considerations Best suited for: Long-term investors who believe in secular growth in childcare/workforce services, and who can tolerate volatility. Those comfortable with modest profitability and reinvestment in growth. Consider risk tolerances: Short-term traders may face volatility from earnings guidance or economic sensitivity. Value investors should compare BFAM’s valuations versus growth prospects and alternatives.

MACD -RSI Chart |

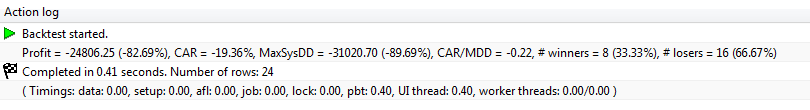

Backtesting (bbelow) using MACD method would have shown this stock to get crushed. The method works well with reacting stocks and this stock has had some favvorable gains during reactive periods. But long stable periods of steady trends have outdone the reactive phases making this more of a buy and hold stock. Right now it may be beginning a long uptrend.

Corporate Website Excerpts |

News Items |

Zenith Index |

Management's Discussion: Results of Operations |

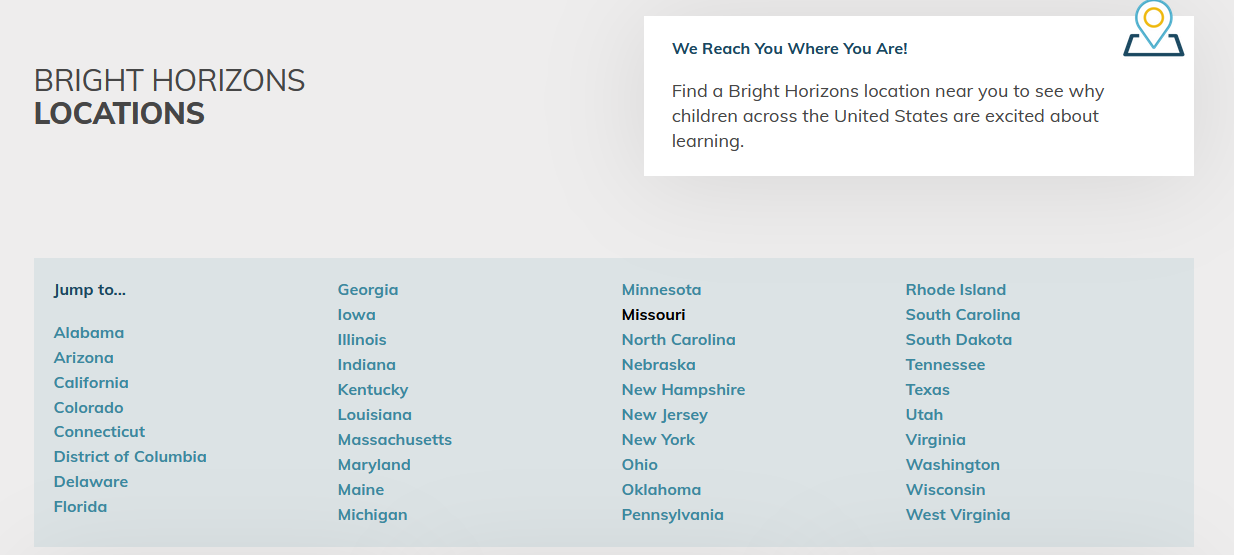

Overview We are a leading provider of high-quality education and care, including early education and child care, back-up and family care solutions, and workforce education services that are designed to help families, employers and their employees solve the challenges of the modern workforce and thrive personally and professionally. We provide services primarily under multi-year contracts with employers who offer early education and child care, back-up care, and educational advisory services as part of their employee benefits package in an effort to support employees across life and career stages and to improve recruitment, employee engagement, productivity, retention, and career advancement. At December 31, 2024, we operated 1,019 early education and child care centers, consisting of 599 centers in North America and 420 centers internationally. We have the capacity to serve approximately 115,000 children in the United States, the United Kingdom, the Netherlands, Australia and India. We seek to cluster centers in geographic areas to enhance operating efficiencies and to create a leading market presence. At December 31, 2024, we had more than 1,450 client relationships with employers across a diverse array of industries, including more than 220 Fortune 500 companies. At December 31, 2024, we managed child care centers on behalf of single employers in the following industries and also managed lease/consortium locations in approximately the following proportions: Percentage of Centers Classification North America International Employer locations: Healthcare and Pharmaceuticals 20.0 % 2.0 % Government and Higher Education 12.5 2.0 Financial Services 7.5 2.0 Consumer 7.5 — Technology 5.0 — Professional Services and Other 5.0 — Industrial/Manufacturing 2.5 1.0 60.0 7.0 Lease/consortium locations 40.0 93.0 100.0 % 100.0 % Our reportable segments are comprised of (1) full service center-based child care, (2) back-up care, and (3) educational advisory services. Full service center-based child care includes traditional center-based early education and child care, preschool, and elementary education. Back-up care consists of center-based back-up child care, in-home care for children and seniors, school age programs (including camps and tutoring), pet care, self-sourced reimbursed care, and Sittercity, an online marketplace for families and caregivers. Educational advisory services includes tuition assistance and student loan repayment program management, workforce education, related educational advising, and college admissions counseling services. Effective January 1, 2024, we realigned our organizational structure to better reflect synergies across certain business lines resulting in a change in reportable segments. As a result, the back-up care reportable segment now includes the Sittercity operations, which were previously reported in the educational advisory and other services segment. Segment information for 2023 has been recast to conform to the current year presentation. Additional information about our operations, structure and services is included in “Business — Our Operations” in Item 1 of this Annual Report on Form 10-K. Additional segment information is included in Note 18, Segment and Geographic Information, to the consolidated financial statements in Item 8 of this Annual Report on Form 10-K. During the year ended December 31, 2024, we saw solid year-over-year revenue growth, with a 10% increase in revenue for our full service center-based child care segment and net enrollment growth of 4% as centers continue to grow enrollment. To track our continued progress, we monitor same-center occupancy for a cohort of centers that has been operating since the 2021 fall enrollment cycle. Same-center occupancy represents utilization for each respective center and is calculated as the average full-time enrollment divided by the total operating capacity during the period. This cohort of centers totaled 768 centers as of December 31, 2024. For the quarter ended December 31, 2024, 39% of these centers were more than 70% enrolled, 45% were between 40-70% enrolled and 16% were less than 40% enrolled, which reflects improved occupancy when compared to the same period in the prior year. We also saw strong growth in back-up care with a 16% year-over-year increase in revenue as a result of increased utilization. While we continue to see year-over-year growth and progress, we are navigating a dynamic operating environment that is impacted by increased operating costs, a tight labor market, varying enrollment demands, shifting work demographics, and challenging macroeconomic conditions. We continue to monitor and respond to the changing conditions and operating environments, and the evolving needs of clients, families and children, including the optimization of our portfolio of centers through the routine closure of underperforming centers to accommodate evolving changes in demand in the markets we serve. As a result of changing conditions, there has been an elevated number of center closures in recent years, totaling 56 in 2024 and 49 in 2023, in addition to the impairment of certain assets. While we continue to review the portfolio of centers and monitor workforce changes in certain markets, such as return to office policies, we expect to close fewer centers in 2025. Where possible, we shift enrollment and teachers to other centers at nearby locations. As we continue to navigate this dynamic operating environment, we remain committed to serving the needs of families, clients and our employees. We are confident in our value proposition, business model, the strength of our client partnerships, the strength of our balance sheet and liquidity position, and our ability to continue to respond to changing market conditions. Our ability to continue to increase operating income in the future, will depend upon our ability to continue to regain and sustain the following characteristics of our business and our strategic growth priorities: •maintenance and incremental growth of enrollment in our mature and ramping centers, and cost management in response to changes in enrollment and demand in our centers; •attraction and retention of qualified early childhood educators to meet the enrollment demand; •effective pricing strategies, including tuition increases that correlate with expected increases in personnel costs, including wages and benefits, and additional pricing actions to accommodate higher operating costs and the impact of persistent inflation; •maintenance and incremental growth of client relationships, additional growth in expanded service offerings and cross-selling of services to clients; •additional growth in the number of back-up care uses, care use types and supply of service providers; •successful identification and integration of acquisitions and transitions of management of centers; and, •successful management of underperforming centers, through improved enrollment or exit and management of costs. Results of Operations Year Ended December 31, 2024 Compared to the Year Ended December 31, 2023 Revenue. Revenue increased by $267.8 million, or 11%, to $2.7 billion for the year ended December 31, 2024 from $2.4 billion for the prior year. Revenue generated by the full service center-based child care segment in the year ended December 31, 2024 increased by $181.2 million, or 10%, when compared to the prior year. Tuition revenue increased by $166.3 million, or 10%, when compared to the prior year, due to a 4% net increase in enrollment and average tuition rate increases at our child care centers of approximately 5%. Fluctuations in foreign currency exchange rates for our United Kingdom, Netherlands and Australia operations also contributed to our revenue growth, increasing 2024 tuition revenue by approximately $9.2 million. Management fees and operating subsidies from employer sponsors increased $14.9 million, or 9%, primarily due to higher operating subsidies required to support center operations as enrollment continues to increase, and due to a decrease in funding received from pandemic-related government support programs as most of the programs for which we were eligible expired in September 2023. Funding received from pandemic-related government support programs reduced certain center operating costs, which impact the related operating subsidies. During the year ended December 31, 2023, such funding reduced the operating subsidy revenue due from employers by $17.5 million. Revenue generated by back-up care services in the year ended December 31, 2024 increased by $84.2 million, or 16%, when compared to the prior year. Revenue growth in the back-up care segment was primarily attributable to increased utilization of center-based, in-home and school-age camp back-up care from new and existing clients. Revenue generated by educational advisory services in the year ended December 31, 2024 increased by $2.4 million, or 2%, when compared to the prior year. Revenue growth in this segment was primarily attributable to increased utilization. Cost of Services. Cost of services increased $179.9 million, or 10%, to $2.1 billion for the year ended December 31, 2024 from $1.9 billion for the prior year. Cost of services in the full service center-based child care segment increased by $143.2 million, or 9%, to $1.7 billion in the year ended December 31, 2024, when compared to the prior year. The increase in cost of services was primarily associated with increased personnel costs related to expanded enrollment and wage rate increases. Personnel costs increased 7% during the year ended December 31, 2024 compared to the same period in the prior year. In addition to the personnel costs for the incremental 4% net enrollment increase noted above and premiums associated with the deployment of temporary staff to meet enrollment demands, we continue to invest in higher wages for our center staff, resulting in an increase of approximately 4% to the average hourly wage in 2024 compared to 2023. Cost of services also includes impairment costs of $29.8 million in 2024 and $32.0 million in 2023, primarily related to fixed assets and operating lease right of use assets. Additionally, most of the pandemic-related government support programs for which we were eligible ended September 2023. Funding received from pandemic-related government support programs reduced center operating expenses by $49.4 million in the year ended December 31, 2023. As noted above, a portion of the funding received from government support programs reduced the operating costs in certain employer-sponsored centers, which in turn reduced the operating subsidy revenue due from employers for the related child care centers by $17.5 million in the year ended December 31, 2023. Cost of services in the back-up care segment increased by $34.9 million, or 12%, to $322.2 million in the year ended December 31, 2024, when compared to the prior year. The increase in cost of services correlates to the increase in revenue and is primarily associated with higher care provider fees generated by the increase in utilization levels of center-based and in-home back-up care over the prior year, and continued investment in personnel, marketing and technology to support our customer user experience and service offerings. Additionally, cost of services in 2024 also includes impairment costs of $1.1 million. Cost of services in 2023 included value-added tax expense of $4.0 million related to prior periods and impairment costs of $3.9 million related to fixed assets and operating lease right of use assets. Cost of services in the educational advisory services segment increased by $1.8 million, or 3%, to $58.5 million in the year ended December 31, 2024, when compared to the prior year due to investments in personnel, product suite and technology to support customer access and user experience. We expect to make additional investments in this segment over the next few years as we further enhance our educational advisory offerings to meet the needs of the modern employer and employee. Gross Profit. Gross profit increased by $87.9 million, or 17%, to $619.6 million for the year ended December 31, 2024 from $531.7 million for the prior year. Incremental gross profit contributions from higher utilization of back-up care services, as well as contributions from our full service center-based child care centers from enrollment growth, tuition price increases, improving operating leverage and lower impairment losses, were partially offset by reduced funding from pandemic-related government support programs. Gross profit margin was 23% of revenue for the year ended December 31, 2024, a 1% increase compared to 22% for the year ended December 31, 2023. Selling, General and Administrative Expenses (“SGA”). SGA increased $27.5 million, or 8%, to $354.6 million for the year ended December 31, 2024 from $327.1 million for the year ended December 31, 2023, due to higher personnel costs, impairment costs of $3.0 million related to the full service center-based child care segment and a $2.3 million charge within the back-up care segment resulting from the early settlement of contingent consideration for a 2021 acquisition. SGA was approximately 13% of revenue for the year ended December 31, 2024, consistent with 2023. Amortization of Intangible Assets. Amortization expense on intangible assets was $18.3 million for the year ended December 31, 2024, a decrease from $33.4 million in the prior year, primarily due to certain intangible assets becoming fully amortized during the period, partially offset by increases from intangible assets acquired in relation to the acquisitions completed in 2023 and 2024. Refer to Note 6, Goodwill and Intangible Assets, to the consolidated financial statements in Item 8 of this Annual Report on Form 10-K for additional details. Income from Operations. Income from operations increased by $75.4 million, or 44%, to $246.6 million for the year ended December 31, 2024 when compared to the prior year. A change in income from operations was due to the following: •Income from operations for the full service center-based child care segment increased $44.3 million, or 472%, for the year ended December 31, 2024, when compared to the same period in 2023, primarily due to increases in tuition revenue from enrollment growth and tuition rate increases, partially offset by increased personnel costs, and a decrease of approximately $34 million in net contributions from pandemic-related government support as most of the programs for which we were eligible ended by September 30, 2023. •Income from operations for the back-up care segment increased $33.9 million, or 25%, in the year ended December 31, 2024 when compared to the same period in 2023. Incremental contributions from the expanded utilization of back-up care services were partially offset by the related higher personnel and service provider costs. Additionally, income from operations in 2023 included value-added tax expense of $4.0 million related to prior periods. •Income from operations for the educational advisory services segment decreased $2.8 million, or 11%, in the year ended December 31, 2024 when compared to the same period in 2023 due to personnel, product design, and technology platform investments to support revenue growth and business transformation. Net Interest Expense. Net interest expense decreased to $48.8 million for the year ended December 31, 2024 from $51.6 million for the year ended December 31, 2023, due to lower average borrowings, lower outstanding deferred consideration from prior acquisitions, and higher interest income from invested cash balances in the current year. The blended weighted average interest rates for the term loans and revolving credit facility were 4.88% and 4.11% for the years ended December 31, 2024 and 2023, respectively, inclusive of the effects of cash flow hedges. Based on our current interest rate projections, we estimate that our overall weighted average interest rate will approximate 5.00% for 2025 inclusive of the effects of cash flow hedges. Income Tax Expense. We recorded an income tax expense of $57.7 million during the year ended December 31, 2024, at an effective income tax rate of 29%, compared to income tax expense of $45.4 million, at an effective income tax rate of 38%, during the prior year. The difference between the effective income tax rates as compared to the statutory income tax rates was primarily due to the impact of unbenefited losses in certain foreign jurisdictions and the effects of excess (shortfall) tax benefit (expense) associated with the exercise or expiration of stock options and vesting of restricted stock. Net shortfall tax expense increased tax expense by $1.0 million in 2024 and by $2.9 million in 2023, due to lower volume of equity transactions and less tax shortfall realized on each transaction in 2024. Adjusted EBITDA and Adjusted Income from Operations. Adjusted EBITDA and adjusted income from operations increased $57.2 million, or 16%, and $65.2 million, or 31%, respectively, for the year ended December 31, 2024 over the comparable period in 2023 primarily due to the incremental gross profit contributions from the full service center-based child care segment resulting from enrollment growth and tuition price increases and from the back-up care segment resulting from increased utilization. Adjusted Net Income. Adjusted net income increased $38.9 million, or 24%, for the year ended December 31, 2024 when compared to the same period in 2023, primarily due to the increase in adjusted income from operations and lower interest expense. Non-GAAP Financial Measures and Reconciliation In our quarterly and annual reports, earnings press releases and conference calls, we discuss key financial measures that are not calculated in accordance with GAAP to supplement our consolidated financial statements presented on a GAAP basis. These non-GAAP financial measures of adjusted EBITDA, adjusted income from operations, adjusted net income and diluted adjusted earnings per common share are reconciled from their most directly comparable financial measures determined in accordance with GAAP. Compensation-Stock Compensation. Other costs in the year ended December 31, 2024 consist of costs incurred in connection with the December 2024 debt refinancing of $0.8 million allocated to the full service center-based child care segment. Other costs in the year ended December 31, 2023 consist of value-added tax expense of $5.5 million related to prior periods, of which $4.0 million was associated with the back-up care segment and $1.5 million was associated with the full service center-based child care segment. Interest on deferred consideration represents the imputed interest on the deferred consideration issued in connection with the July 1, 2022 acquisition of Only About Children. The deferred consideration was paid in January 2024. Adjusted income tax expense represents income tax expense calculated on adjusted income before income tax at an effective tax rate of approximately 28% for each of the years ended December 31, 2024 and 2023. Adjusted EBITDA, adjusted income from operations, adjusted net income and diluted adjusted earnings per common share are financial measures that are not calculated in accordance with GAAP (collectively referred to as the “non-GAAP financial measures”), and the use of the terms adjusted EBITDA, adjusted income from operations, adjusted net income and diluted adjusted earnings per common share may differ from similar measures reported by other companies and may not be comparable to other similarly titled measures. We believe the non-GAAP financial measures provide investors with useful information with respect to our historical operations. We present the non-GAAP financial measures as supplemental performance measures because we believe they facilitate a comparative assessment of our operating performance relative to our performance based on our results under GAAP, while isolating the effects of some items that vary from period to period. Specifically, adjusted EBITDA allows for an assessment of our operating performance and of our ability to service or incur indebtedness without the effect of non-cash charges, such as depreciation, amortization, and stock-based compensation expense, and non-recurring costs, such as impairment losses, debt refinance costs, value-added tax expense related to prior periods and at times, other non-recurring costs, such as transaction costs. In addition, adjusted income from operations, adjusted net income and diluted adjusted earnings per common share allow us to assess our performance without the impact of the specifically identified items that we believe do not directly reflect our core operations. These non-GAAP financial measures also function as key performance indicators used to evaluate our operating performance internally, and they are used in connection with the determination of incentive compensation for management, including executive officers. Adjusted EBITDA is also used in connection with the determination of certain ratio requirements under our credit agreement. Adjusted EBITDA, adjusted income from operations, adjusted net income and diluted adjusted earnings per common share are not measurements of our financial performance under GAAP and should not be considered in isolation or as an alternative to income before taxes, net income, diluted earnings per common share, net cash provided by (used in) operating, investing or financing activities or any other financial statement data presented as indicators of financial performance or liquidity, each as presented in accordance with GAAP. Consequently, our non-GAAP financial measures should be considered together with our consolidated financial statements, which are prepared in accordance with GAAP and included in Item 8 of this Annual Report on Form 10-K. We understand that although adjusted EBITDA, adjusted income from operations, adjusted net income and diluted adjusted earnings per common share are frequently used by securities analysts, lenders and others in their evaluation of companies, they have limitations as analytical tools, and you should not consider them in isolation, or as a substitute for analysis of our results as reported under GAAP. Liquidity and Capital Resources Our primary cash requirements are for the ongoing operations of our existing early education and child care centers, back-up care, educational advisory services, the addition of new centers through development or acquisitions, and debt financing obligations. Our primary sources of liquidity are our existing cash, cash flows from operations, and borrowings available under our revolving credit facility. We had $110.3 million in cash ($123.7 million including restricted cash) at December 31, 2024, of which $45.5 million was held in foreign jurisdictions, compared to $71.6 million in cash ($89.5 million including restricted cash) at December 31, 2023, of which $32.1 million was held in foreign jurisdictions. Operations outside of North America accounted for 28% and 27% of our consolidated revenue for the years ended December 31, 2024 and 2023, respectively. The net impact on our liquidity from changes in foreign currency exchange rates was not material for the years ended December 31, 2024 and 2023. Our $400 million revolving credit facility is part of our senior secured credit facilities. At December 31, 2024 and 2023, $384.8 million and $380.7 million of the revolving credit facility was available for borrowing, respectively. We had a working capital deficit of $283.4 million and $352.5 million at December 31, 2024 and December 31, 2023, respectively. Our working capital deficit has primarily arisen from using cash to make long-term investments in fixed assets and acquisitions, deferred consideration issued in relation to an acquisition and from share repurchases. We anticipate that our cash flows from operating activities will continue to expand as our center enrollment and performance continues to improve. As we continue growing enrollment, we expect to allocate capital to investments that support current operations and strategic opportunities, as well as the principal and interest payments on our debt, including voluntary prepayments, and revolver, and share repurchases from time to time. In January 2024, the Company paid deferred consideration of $106.5 million related to the 2022 acquisition of Only About Children. During the year ended December 31, 2023, we participated in certain government support programs that were enacted in response to the economic impact of the pandemic. With the expiration of the child care stabilization grants on September 30, 2023, most of the pandemic-related government support programs for which we were eligible ended in 2023. During the year ended December 31, 2023, $49.4 million was recorded as a reduction to cost of services in relation to these benefits, of which $17.5 million reduced the operating subsidies paid by employers for the related child care centers. Additionally, during the year ended December 31, 2023, $1.7 million was recorded to revenue related to amounts received for tuition support. As of December 31, 2024, we had $845.7 million in lease liabilities, $102.1 million of which is short term in nature. Refer to Note 4, Leases, to the consolidated financial statements in Item 8 of this Annual Report on Form 10-K for additional information on leases, including the maturity of the contractual obligations related to our lease liabilities. The board of directors authorized a share repurchase program of up to $400 million of our outstanding common stock, effective December 16, 2021. The share repurchase program has no expiration date. During the year ended December 31, 2024, we repurchased 0.8 million shares for $84.6 million (resulting in a $0.4 million excise tax liability). There were no share repurchases during the year ended December 31, 2023. All repurchased shares have been retired, and at December 31, 2024, $113.7 million remains available for future repurchases under the Board-approved repurchase program. We believe that funds provided by operations, our existing cash balances and borrowings available under our revolving credit facility will be adequate to fund all obligations and liquidity requirements for at least the next 12 months. However, if we were to experience disruption from events not in our control, such as a global health crisis, or if we were to undertake any significant acquisitions or make investments in the purchase of facilities for new or existing centers, we could require financing beyond our existing cash and borrowing capacity, and it could be necessary for us to obtain additional debt or equity financing. We may not be able to obtain such financing on reasonable terms, or at all. Cash Provided by Operating Activities Cash provided by operating activities was $337.5 million for the year ended December 31, 2024, compared to $256.1 million for 2023. The increase in cash provided by operations primarily relates to the increase in net income of $66.0 million, as well as higher cash provided by working capital arising from the timing of billings and payments when compared to the prior year. Cash Used in Investing Activities Cash used in investing activities was $117.8 million for the year ended December 31, 2024, compared to $126.9 million for the prior year, a decrease of $9.1 million. The decrease in cash used in investing activities was primarily related to a decrease in payments for acquisitions. During the year ended December 31, 2024, we invested $8.3 million in acquisitions, compared to an investment of $39.6 million during the prior year. This decrease in cash used in investing activities was partially offset by an increase in net purchases of debt securities and other investments in 2024. Net purchases of debt securities by our captive insurance entity, using restricted cash, and other investments were $14.2 million in the year ended December 31, 2024, compared to net proceeds of $3.5 million during the prior year, a net increase in cash used of $17.7 million. In addition, during the year ended December 31, 2024, we had net investments of $95.3 million in fixed asset purchases for maintenance and refurbishments in our existing centers, technology across all segments, and new child care centers, compared to net investments of $90.8 million during the prior year, a net increase of $4.5 million. We expect that in 2025 we will continue to spend on fixed asset additions related to new child care centers, maintenance and refurbishments in our existing centers, and continued investments in technology and equipment. As part of our growth strategy, we also expect to continue to make selective acquisitions. Cash Used in Financing Activities Cash used in financing activities was $183.8 million for the year ended December 31, 2024 compared to $91.6 million for the same period in 2023. The increase in cash used in financing activities during the year ended December 31, 2024 was related to payments for deferred and contingent consideration and share repurchases, offset by a decrease in net payments under our revolving credit facility. During the year ended December 31, 2024, we made payments for deferred and contingent consideration of $103.9 million, of which $97.7 million related to the deferred consideration for the 2022 acquisition of Only About Children and $6.2 million related to the contingent consideration for a 2021 acquisition, compared to $0.2 million for payments of contingent consideration during the same period in 2023. During the year ended December 31, 2024, we used $84.6 million in cash for share repurchases, compared to no repurchases in 2023. These increases in cash used were partially offset by a decrease in net payments related to our revolving credit facility, which were $84.0 million during the ended December 31, 2023, compared to zero in the year ended December 31, 2024. Additionally, proceeds received from the exercise of employee equity awards increased to $27.0 million in the year ended December 31, 2024 compared to $11.2 million in 2023, an increase of $15.8 million, due to a higher volume of transactions and higher exercise prices. Debt Our senior secured credit facilities consist of a $600 million term loan B facility (“term loan B”), a $400 million term loan A facility (“term loan A”), and a $400 million multi-currency revolving credit facility (“revolving credit facility”). On December 11, 2024, the Company amended its existing senior secured credit facilities to, among other changes, reduce the applicable interest rates of the term loan B facility. The Company incurred $0.8 million in fees associated with this amendment in the year ended December 31, 2024, which were included in selling, general and administrative expenses. The seven-year term loan B matures on November 23, 2028 and requires quarterly principal payments equal to 1% per annum of the aggregate principal amount of the term loan B as of December 11, 2024, the date the Company amended its senior secured credit facility, with the remaining principal balance due at maturity. The five-year term loan A matures on November 23, 2026 and requires quarterly principal payments equal to 2.5% per annum of the original aggregate principal amount of the term loan A in each of the first three years, 5% in the fourth year, and 7.5% in the fifth year. The remaining principal balance is due at maturity. The revolving credit facility matures on May 26, 2026. At December 31, 2024 and December 31, 2023, there were no borrowings outstanding under the revolving credit facility and letters of credit outstanding under the revolver were $15.2 million and $19.3 million, respectively, with $384.8 million and $380.7 million available for borrowing, respectively. Borrowings under the credit facilities are subject to variable interest. We mitigate our interest rate exposure with interest rate cap agreements. In June 2020, we entered into interest rate cap agreements with a total notional value of $800 million to provide us with interest rate protection in the event the one-month term SOFR rate increases above 0.9%. Interest rate cap agreements for $300 million notional value had an effective date of June 30, 2020 and expired on October 31, 2023, while interest rate cap agreements for another $500 million notional amount had an effective date of October 29, 2021 and expired on October 31, 2023. In December 2021, we entered into additional interest rate cap agreements with a total notional value of $900 million. Interest rate cap agreements for $600 million, which had a forward starting effective date of October 31, 2023 and expire on October 31, 2025, provide the Company with interest rate protection in the event the one-month term SOFR rate increases above 2.4%. Interest rate cap agreements for $300 million, which had a forward starting effective date of October 31, 2023 and expire on October 31, 2026, provide the Company with interest rate protection in the event the one-month term SOFR rate increases above 2.9%. The blended weighted average interest rate for the term loans and revolving credit facility was 4.88%, and 4.11% for the years ended December 31, 2024 and 2023, respectively, including the impact of the cash flow hedges. Based on our current interest rate projections, we estimate that our overall weighted average interest rate will approximate 5.00% for 2025, inclusive of the effects of cash flow hedges. Based on the interest rates in effect as of December 31, 2024, interest payments on the outstanding principal balance of the term loans, including commitment fees on the revolving credit facility, are expected to range between $30 million and $60 million annually over the remaining term, prior to the inclusion of the effects of cash flow hedges. However, actual interest paid may be different from these estimates based on changes in interest rates and borrowings outstanding. The term loan A and the revolving credit facility require Bright Horizons Family Solutions LLC, the borrower, and its restricted subsidiaries to comply with a maximum first lien net leverage ratio. A breach of this covenant is subject to certain equity cure rights. The credit agreement governing the senior secured credit facilities contains certain customary affirmative covenants and events of default. We were in compliance with our financial covenant at December 31, 2024. Critical Accounting Policies and Estimates We prepare our consolidated financial statements in accordance with U.S. GAAP. Preparation of the consolidated financial statements requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the consolidated financial statements, as well as the reported amounts of revenue and expenses during the reporting period. Actual results could differ from these estimates. The accounting policies and estimates we believe are critical in the preparation of our consolidated financial statements relate to revenue recognition and goodwill and other intangible assets. Revenue Recognition — We generate revenue from services based on the nature of the promise and the consideration specified in contracts with customers. At contract inception, we assess the services promised in the contract and identify each distinct performance obligation. The transaction price of a contract is allocated to each distinct performance obligation using the relative stand-alone selling price and recognized as revenue when, or as, control of the service is passed to the customer. The application of these policies to the services provided by each of our segments is discussed below. Our revenue recognition policy generally does not have significant judgments or estimates that significantly affect the determination of the amount, the allocation of the transaction price to performance obligations, or timing of revenue from contracts with customers. The nature of our services does not require significant judgment or estimates to determine when control transfers to the customer. Based on past practices and customer specific circumstances, we occasionally may grant concessions that impact the total transaction price. If the transaction price may be subject to adjustment, significant judgment may be required to ensure that it is probable that significant reversal in the amount of cumulative revenue recognized will not occur. As of December 31, 2024 and 2023, there were no material estimates related to the constraint of cumulative revenue recognized. Full-Service Center-Based Child Care Our full-service center-based child care services include traditional center-based early education and child care, preschool, and elementary education. We provide center-based child care services under two principal business models: (1) a cost-plus model, where we are paid a fee by an employer client for managing a child care center on a cost-plus basis, and (2) a profit and loss (“P&L”) model, where we assume the financial risk of operating a child care center and provide care on either an exclusive or priority enrollment basis to the employees of an employer sponsor, as well as to families in the surrounding community. In both the cost-plus model and P&L model sponsored by an employer, the employer sponsor retains responsibility for the development of a new child care center (which is generally owned or leased by the sponsor), as well as ongoing maintenance and repairs. In addition, employer sponsors typically provide subsidies for the ongoing provision of child care services to their employees. Under all model types, we retain responsibility for all aspects of operating the child care center, including the hiring, training, supervising and compensating of employees, contracting with vendors, purchasing supplies, and collecting tuition and related accounts receivable. Revenue generated from full-service center-based child care services is primarily comprised of monthly tuition paid by parents. Tuition is determined based on the age and developmental level of the child, the child’s attendance schedule, and the geographic location of the facility. The full-service child care offering provided to parents represents a series of distinct services that are substantially the same and have the same pattern of transfer to the customer over time, which transfers daily. The tuition paid by parents is recognized on a daily basis, but for convenience is recorded on a monthly basis. We enter into contracts with employer sponsors to manage and operate their early education and child care centers for a management fee, or to provide child care services to their employees on an exclusive or priority basis. These arrangements generally have a contractual term of 3 to 10 years with varying terms and renewal and cancellation options, and may also include operating subsidies paid either in lieu of or to supplement parent tuition. The management fee included in contracts with employer sponsors is typically a monthly amount, and generally includes an annual escalator that is intended to reflect expected future cost increases. Annual escalators are generally stated as a percentage or as a reference to a consumer price index. The contracts also generally include a termination right with a notice period. We allocate revenue for contracts with an accounting term in excess of one year to the applicable contract year based on the rates applicable for that annual period, which is commensurate with the expected increases to the cost of providing the service, our standard pricing practices, as well as the overall allocation objective described in the guidance. Services provided to the employer sponsor represent a series of distinct services that are substantially the same and have the same pattern of transfer to the customer over time, which transfers daily. Fees paid by the employer sponsor are recognized on a daily basis, but for convenience are recorded on a monthly basis (i.e., the same monthly amount within the contract year using the time elapsed method). Certain arrangements provide that the employer sponsor pay operating subsidies in lieu of, or to supplement, parent tuition. The employer subsidy for cost-plus managed centers, which consists of variable consideration, is typically calculated as the difference between parent tuition revenue and the operating costs for the center for each respective month and is recognized as revenue in the month the services are provided. The variable consideration relates specifically to efforts to transfer each distinct daily service and the allocation of the consideration earned to that distinct day in which those activities are performed is consistent with the overall allocation objective. Back-Up Care Services Back-up care services consist of center-based back-up child care, in-home child and senior care, school-age programs (including camps and tutoring), pet care, self-sourced reimbursed care and Sittercity, an online marketplace for families and caregivers. We provide back-up care services through our early education and child care centers, school-age programs and in-home caregivers, as well as through the back-up care network and through other providers. Our back-up care offers access to a contracted network of in-home service agencies and center-based providers in locations where we do not otherwise have in-home caregivers or child care centers with available capacity, to a network of tutoring service providers and third-party pet care providers. Self-sourced reimbursed care is a reimbursement program available to employer sponsors when other care solutions are not available, to provide payments to their employees to assist with the cost of self-sourced dependent care. Back-up care revenue is primarily comprised of fixed and variable consideration paid by employer sponsors, and, to a lesser extent, co-payments collected from users at the point of service. These arrangements generally have contractual terms of three years with varying terms and renewal and cancellation options. Fees for back-up care services are typically determined based on the number of back-up uses purchased, which may be fixed based on a specified number of uses or variable fees paid per use, and are generally billed monthly as services are rendered or in advance. Revenue for back-up care services is generally recognized over time as the services are performed and is recognized in the month the back-up services are provided. Allocation of the consideration earned as the service is performed is consistent with the overall allocation objective. Revenue for self-sourced reimbursed care and certain pet care is based on a fee earned for each transaction processed and is recorded on a net basis as we are acting as an agent, and is recognized in the month the transactions are processed. In fiscal year 2024, we realigned our organizational structure to better reflect synergies across certain business lines resulting in a change in reportable segments. As a result, effective January 1, 2024, the back-up care reportable segment includes the Sittercity operations. Revenue is primarily generated from subscriptions, comprised of fixed fees for the subscription period and, to a lesser extent, variable transaction fees collected from users at the point of service. Subscription fees are recognized on a straight-line basis using the time-elapsed method over the contract term, and variable transaction fees earned are allocated to that distinct transaction consistent with the overall allocation objective. Educational Advisory Services Our educational advisory services consist of tuition assistance and student loan repayment program management, workforce education, and related educational consulting services (“EdAssist”), and college admissions and college financing advisory services (“College Coach”). Educational advisory services revenue is primarily comprised of fixed and variable fees paid by employer clients for program management, coaching, and subscription of content, and, to a lesser extent, retail fees collected from users at the point of service. These arrangements generally have contractual terms of three years with varying terms and renewal and cancellation options. Fees for educational advisory services are determined based on the expected number of program participants and the services selected, and are generally billed in advance. Revenue for EdAssist is recognized on a straight-line basis using the time-elapsed method over the contract term with additional charges recognized in the month the additional services are provided consistent with the overall allocation objective. Additionally, revenue for tuition assistance and student loan repayments is based on a fee earned for transactions processed and is recorded on a net basis as we are acting as the agent for the processing of the payment from clients to their employees, and is recognized in the month the payments are processed. Revenue for College Coach is recognized over the contract term as college admissions counseling and other advisory services are provided and customers receive the benefit. Goodwill, Intangible Assets and Long-Lived Assets — We account for business combinations under the acquisition method of accounting. Amounts paid for an acquisition are allocated to the assets acquired and liabilities assumed based on their fair values at the date of acquisition. Goodwill is recorded when the consideration paid for an acquisition exceeds the fair value of the net tangible and identifiable intangible assets acquired. Our intangible assets principally consist of various customer relationships (including both client and parent relationships) and trade names. Identified intangible assets that have determinable useful lives are valued separately from goodwill and are amortized over the estimated period during which we derive a benefit. Intangible assets related to parent relationships are amortized using an accelerated method over their useful lives. All other intangible assets are amortized on a straight-line basis over their useful lives. In valuing the customer relationships and trade names, we utilize variations of the income approach, which relies on historical financial and qualitative information, as well as assumptions and estimates for projected financial information. We consider the income approach the most appropriate valuation technique because the inherent value of these assets is their ability to generate current and future income. Projected financial information is subject to risk if our estimates are incorrect. The most significant estimate relates to projected revenues and profitability. If the projected revenues and profitability used in the valuation calculations are not met, then the intangible assets could be impaired. Our multi-year contracts with client customers typically result in low annual turnover, and our long-term relationships with clients make it difficult for competitors to displace us. Customer relationships are considered to be finite-lived assets, with estimated lives typically ranging from 2 to 17 years. Certain trade names acquired as part of our strategy to expand by completing strategic acquisitions are considered to be finite-lived assets, with estimated lives typically ranging from 2 to 10 years. Goodwill and certain trade names are considered to be indefinite-lived assets. Our trade names identify us and differentiate us from competitors and, therefore, competition does not limit the useful life of these assets. Additionally, we believe that our primary trade names will continue to generate revenue for an indefinite period. Goodwill and intangible assets with indefinite lives are not subject to amortization, but are tested annually for impairment or more frequently if there are indicators of impairment. Indefinite lived intangible assets are also subject to an annual evaluation to determine whether events and circumstances continue to support an indefinite useful life. Goodwill impairment assessments are performed at the reporting unit level. In performing the goodwill impairment test, we may first assess qualitative factors to determine whether it is more likely than not that the fair value of a reporting unit is less than the carrying value. Qualitative factors may include, but are not limited to, macroeconomic conditions, industry conditions, the competitive environment, changes in the market for the services, regulatory developments, cost factors, and entity specific factors such as overall financial performance and projected results. If an initial qualitative assessment indicates that it is more likely than not that the carrying value exceeds the fair value of a reporting unit, an additional quantitative evaluation is performed. Alternatively, we may elect to proceed directly to the quantitative impairment test. In performing the quantitative analysis, we compare the fair value of the reporting unit with its carrying amount, including goodwill. Fair value for each reporting unit is determined by estimating the present value of expected future cash flows, which are forecasted for each of the next 10 years, applying a long-term growth rate to the final year, discounted using the applicable discount rate. If the fair value of the reporting unit exceeds its carrying amount, the goodwill of the reporting unit is considered not impaired. If the carrying amount of the reporting unit exceeds its fair value, we would recognize an impairment charge for the amount by which the carrying amount of the reporting unit exceeds its fair value, up to the amount of goodwill allocated to that reporting unit. The Company recorded impairment charges related to goodwill of $4.2 million in the year ended December 31, 2024. We test certain trademarks that are determined to be indefinite-lived intangible assets by comparing the fair value of the trademarks with their carrying value. Fair value is determined by estimating the total revenue attributable to each trademark, multiplied by a market-derived royalty rate, and then discounted using the applicable discount rate. The forecasts of revenue and profitability growth for use in our long-range plan and the discount rate are the key assumptions in our fair value analysis. We review long-lived assets, including definite-lived intangible assets, for possible impairment whenever events or changes in circumstances indicate that the carrying amounts of such assets may not be recoverable. Impairment is assessed by comparing the carrying amounts of the assets to the estimated undiscounted future cash flows over the assets remaining lives. If the estimated cash flows are less than the carrying amounts of the assets, an impairment loss is recognized to reduce the carrying amounts of the assets to its estimated fair value. The estimated fair value is determined based on discounting estimated cash flows, including consideration of market rates for leased assets. The impairment is allocated to the long-lived assets on a pro rata basis using the relative carrying amounts, but only to the extent the carrying amount of an asset is above its fair value. During the year ended December 31, 2024, we recorded impairment charges for long-lived assets of $30.9 million related to fixed assets, operating lease right-of-use assets and intangibles. Quantitative and Qualitative Disclosures About Market Risk Our primary market risk exposures relate to foreign currency exchange rate risk and interest rate risk. Foreign Currency Risk Our exposure to fluctuations in foreign currency exchange rates is primarily the result of foreign subsidiaries domiciled in the United Kingdom, the Netherlands, Australia, and India. We have not used financial derivative instruments to hedge foreign currency exchange rate risks associated with operations at our foreign subsidiaries. The assets and liabilities of our subsidiaries in the United Kingdom, the Netherlands, Australia, and India, whose functional currencies are the British pound, Euro, Australian dollar and Indian rupee, respectively, are translated into U.S. dollars at exchange rates in effect at the balance sheet date. Income and expense items are translated at the average exchange rates prevailing during the period. The cumulative translation effects for subsidiaries using a functional currency other than the U.S. dollar are included in accumulated other comprehensive loss as a separate component of stockholders’ equity. We estimate that had the exchange rate in each country unfavorably changed by 10% relative to the U.S. dollar, our consolidated income before income tax would have decreased by approximately $3.2 million for 2024. Interest Rate Risk Interest rate exposure relates primarily to the effect of interest rate changes on borrowings outstanding under our revolving credit facility and term loan facilities that are subject to variable interest rates, and income earned on our investments. We mitigate our interest rate exposure with interest rate cap agreements. In June 2020, we entered into interest rate cap agreements with a total notional value of $800 million, designated and accounted for as cash flow hedges from inception, to provide us with interest rate protection in the event the one-month LIBOR rate increases above 1% (effective December 30, 2022, one-month term SOFR rate increases above 0.9%). Interest rate cap agreements for $300 million notional value had an effective date of June 30, 2020 and expired on October 31, 2023, while interest rate cap agreements for another $500 million notional amount had a forward starting effective date of October 29, 2021 and expired on October 31, 2023. In December 2021, we entered into additional interest rate cap agreements with a total notional value of $900 million, which are designated and accounted for as cash flow hedges from inception. Interest rate cap agreements for $600 million, which had a forward starting effective date of October 31, 2023 and expire on October 31, 2025, provide us with interest rate protection in the event the one-month LIBOR rate increases above 2.5% (effective December 30, 2022, one-month term SOFR rate increases above 2.4%). Interest rate cap agreements for $300 million, which had a forward starting effective date of October 31, 2023 and expire on October 31, 2026, provide us with interest rate protection in the event the one-month LIBOR rate increases above 3.0% (effective December 30, 2022, one-month term SOFR rate increases above 2.9%). At December 31, 2024, we had borrowings outstanding of $951.0 million under our term loan facilities and no borrowings outstanding under our revolving credit facility, which were subject to a weighted average interest rate of 4.88% during the year ended December 31, 2024, including the impact of the interest rate cap agreements. Based on the borrowings outstanding under the senior secured credit facilities during 2024, a hypothetical increase in interest rates of 100 basis points in 2024, would have had an immaterial impact to our interest expense for the year, inclusive of the impact of the interest rate hedge agreements. These estimates assume the interest rate of each variable rate borrowing is raised by 100 basis points. The impact on future interest expense as a result of future changes in interest rates will depend largely on the gross amount of our borrowings subject to variable interest rates and the interest rate cap agreements in place at that time. Therefore, the estimated increase in interest expense as calculated above may not be indicative of future expenses. As of December 31, 2024, the fair value of our interest rate cap agreements was an asset of $14.7 million, of which $8.4 million was recorded in prepaid expenses and other current assets and $6.3 million was recorded in other assets on the consolidated balance sheet. During the year ended December 31, 2024, our wholly-owned captive insurance entity purchased and sold marketable debt securities, which were classified as available-for-sale. As of December 31, 2024, the fair value of the available-for-sale debt securities was $33.7 million, with $11.7 million included in prepaid expenses and other current assets and $22.0 million in other assets on the consolidated balance sheet. Our investments primarily consist of U.S. Treasury and U.S. government agency securities, corporate bonds and certificate of deposits. As of December 31, 2024, a hypothetical increase in interest rates of 100 basis points would not have a material adverse impact on the fair value of our investment portfolio. Any unrealized gains or losses are recorded in accumulated other comprehensive loss and are realized if the debt securities are sold prior to maturity. We may enter into additional derivatives or other market risk sensitive instruments in the future for the purpose of hedging or for other purposes.

Analysts' Ratings |

Below is an interim report on a portion of Zenith's First Quarter covering 01-02-2026 to 02-19-2026. We commit around $30,000 per stock and do not compound investments so share alotments stay constant. Reports are made at odd intervals and trades closed out at the end of each quarter starting with March 31st, then given a fresh start each quarter with new cumulative totals and previous totals out.

Closed Trades

_____________

Trade Total Gain

Date Sym Company BS Shares Price Aft Cm (-Loss)

260102 ADBE Adobe Systems Inc S 113 347.61 $ 39,279 $ 0

260209 ADBE Adobe Systems Inc B 226 265.58 $ 60,021 $ 9,269

260102 AMCX AMC Networks Cl A S 3906 9.48 $ 37,028 $ 0

260209 AMCX AMC Networks Cl A B 7812 7.32 $ 57,183 $ 8,437

260102 AVGO Broadcom Ltd S 88 357.05 $ 31,420 $ 0

260204 AVGO Broadcom Ltd B 176 298.25 $ 52,492 $ 5,174

260203 AXTA Axalta Coating Systems Ltd B 871 31.76 $ 27,662 $ 0

260210 AXTA Axalta Coating Systems Ltd S 1742 34.77 $ 60,569 $ 2,622

260106 BFAM Bright Horizons Family Solutio S 352 103.41 $ 36,400 $ 0

260209 BFAM Bright Horizons Family Solutio B 704 83.81 $ 59,002 $ 6,899

260102 BG Bunge Ltd B 253 89.59 $ 22,666 $ 0

260204 BG Bunge Ltd S 506 120.42 $ 60,932 $ 7,800

260108 BP BP Plc ADR B 811 33.73 $ 27,355 $ 0

260204 BP BP Plc ADR S 1622 39.11 $ 63,436 $ 4,363

260102 CAT Caterpillar Inc B 40 581.06 $ 23,242 $ 0

260210 CAT Caterpillar Inc S 80 744.48 $ 59,558 $ 6,537

260108 CCB Coastal Financial Corp S 341 118.57 $ 40,432 $ 0

260205 CCB Coastal Financial Corp B 682 84.39 $ 57,553 $ 11,656

260102 CELH Celsius Holdings Inc B 647 46.23 $ 29,910 $ 0

260120 CELH Celsius Holdings Inc S 1294 57.27 $ 74,107 $ 7,143

260116 CENTA Central Garden & Pet B 889 28.71 $ 25,523 $ 0

260206 CENTA Central Garden & Pet S 1778 34.16 $ 60,736 $ 4,845

260114 CHEF The Chefs Warehouse B 458 57.96 $ 26,545 $ 0

260209 CHEF The Chefs Warehouse S 916 67.45 $ 61,784 $ 4,347

260105 EPD Enterprise Products Partners L B 852 31.87 $ 27,153 $ 0

260205 EPD Enterprise Products Partners L S 1704 35.19 $ 59,963 $ 2,828

260114 FOUR Shift4 Payments Inc S 501 67.88 $ 34,007 $ 0

260203 FOUR Shift4 Payments Inc B 1002 53.18 $ 53,286 $ 7,364

260102 HLX Helix Energy Solutions Group B 3546 6.21 $ 22,020 $ 0

260209 HLX Helix Energy Solutions Group S 7092 8.69 $ 61,629 $ 8,794

260102 INTC Intel Corp B 636 38.14 $ 24,257 $ 0

260122 INTC Intel Corp S 1272 54.05 $ 68,751 $ 10,118

260102 JBHT J B Hunt Transport B 130 195.48 $ 25,412 $ 0

260210 JBHT J B Hunt Transport S 260 228.60 $ 59,436 $ 4,306

260102 KEYS Keysight Technologies Inc B 127 205.76 $ 26,131 $ 0

260210 KEYS Keysight Technologies Inc S 254 235.59 $ 59,839 $ 3,788

260107 KKR KKR & Company LP S 279 135.91 $ 37,918 $ 0

260205 KKR KKR & Company LP B 558 98.34 $ 54,873 $ 10,482

260121 LEU Centrus Energy Corp S 113 342.14 $ 38,661 $ 0

260204 LEU Centrus Energy Corp B 226 232.82 $ 52,617 $ 12,353

260102 LHX L3Harris Technologies Inc B 86 293.92 $ 25,277 $ 0

260129 LHX L3Harris Technologies Inc S 172 365.89 $ 62,933 $ 6,189

260102 LVS Las Vegas Sands S 526 64.96 $ 34,168 $ 0

260129 LVS Las Vegas Sands B 1052 52.44 $ 55,166 $ 6,585

260115 MPAA Motorcar Parts Amer S 2795 13.60 $ 38,012 $ 0

260209 MPAA Motorcar Parts Amer B 5590 9.38 $ 52,434 $ 11,795

260105 PCVX Vaxcyte Inc B 545 44.38 $ 24,187 $ 0

260203 PCVX Vaxcyte Inc S 1090 58.36 $ 63,612 $ 7,619

260107 PLTR Palantir Technologies Inc Cl A S 215 185.41 $ 39,863 $ 0

260205 PLTR Palantir Technologies Inc Cl A B 430 129.60 $ 55,728 $ 11,999

260108 SNOW Snowflake Inc Cl A S 164 233.95 $ 38,367 $ 0

260205 SNOW Snowflake Inc Cl A B 328 157.64 $ 51,705 $ 12,515

260106 TMHC Taylor Morrison Home Corp B 451 57.82 $ 26,076 $ 0

260210 TMHC Taylor Morrison Home Corp S 902 66.62 $ 60,091 $ 3,969

260106 TT Trane Technologies Plc B 65 351.54 $ 22,850 $ 0

260210 TT Trane Technologies Plc S 130 460.80 $ 59,903 $ 7,101

260113 VOD Vodafone Grp Plc ADR B 1967 13.28 $ 26,121 $ 0

260204 VOD Vodafone Grp Plc ADR S 3934 15.74 $ 61,921 $ 4,839

260108 VRT Vertiv Holdings Llc. B 150 160.36 $ 24,054 $ 0

260209 VRT Vertiv Holdings Llc. S 300 206.35 $ 61,905 $ 6,898

260109 WDFC W D 40 Company B 125 177.13 $ 22,141 $ 0

260205 WDFC W D 40 Company S 250 250.71 $ 62,677 $ 9,197

260129 ZBH Zimmer Biomet Holdings B 328 85.44 $ 28,024 $ 0

260210 ZBH Zimmer Biomet Holdings S 656 94.48 $ 61,978 $ 2,965

260120 ZM Zoom Communications Inc B 315 80.57 $ 25,379 $ 0

260128 ZM Zoom Communications Inc S 630 96.60 $ 60,857 $ 5,049

_________

$ 235,845

Open Positions, Only

_____________________

Recent Total Gain

Date Sym Company BS Shares Price Aft Cm (-Loss)

260108 SNOW Snowflake Inc Cl A S 164 182.58 $ 29,943 $ 4,049

260210 KEYS Keysight Technologies Inc S 127 235.00 $ 29,845 $ 76

260128 ZM Zoom Communications Inc S 315 94.99 $ 29,921 $ 512

260102 AVGO Broadcom Ltd S 88 340.44 $ 29,958 $ 3,676

260102 LVS Las Vegas Sands S 526 57.02 $ 29,992 $ 2,385

260203 PCVX Vaxcyte Inc S 545 54.98 $ 29,964 $ 1,861

260122 INTC Intel Corp S 636 47.13 $ 29,974 $ 4,445

260204 BP BP Plc ADR S 811 36.97 $ 29,982 $ 1,753

260210 AXTA Axalta Coating Systems Ltd S 871 34.42 $ 29,979 $ 308

260206 CENTA Central Garden & Pet S 889 33.74 $ 29,994 $ 377

260107 KKR KKR & Company LP S 279 107.21 $ 29,911 $ 2,450

260210 TT Trane Technologies Plc S 65 461.38 $ 29,989 $ -38

260121 LEU Centrus Energy Corp S 113 264.99 $ 29,943 $ 3,599

260210 CAT Caterpillar Inc S 40 742.37 $ 29,694 $ 85

260102 ADBE Adobe Systems Inc S 113 264.67 $ 29,907 $ -102

260106 BFAM Bright Horizons Family Solutio S 352 85.04 $ 29,934 $ 429

260120 CELH Celsius Holdings Inc S 647 46.35 $ 29,988 $ 7,136

260209 VRT Vertiv Holdings Llc. S 150 199.62 $ 29,942 $ 1,020

260205 WDFC W D 40 Company S 125 238.87 $ 29,858 $ 1,495

260129 LHX L3Harris Technologies Inc S 86 345.08 $ 29,676 $ 1,808

260209 CHEF The Chefs Warehouse S 458 65.36 $ 29,934 $ 967

260114 FOUR Shift4 Payments Inc S 501 59.81 $ 29,964 $ 3,288

260210 ZBH Zimmer Biomet Holdings S 328 91.40 $ 29,979 $ 1,020

260205 EPD Enterprise Products Partners L S 852 35.19 $ 29,981 $ 0

260107 PLTR Palantir Technologies Inc Cl A S 215 139.51 $ 29,994 $ 2,109

260108 CCB Coastal Financial Corp S 341 87.84 $ 29,953 $ 1,165

260209 HLX Helix Energy Solutions Group S 3546 8.46 $ 29,999 $ 824

260115 MPAA Motorcar Parts Amer S 2795 10.73 $ 29,990 $ 3,736

260204 VOD Vodafone Grp Plc ADR S 1967 15.25 $ 29,996 $ 973

260210 TMHC Taylor Morrison Home Corp S 451 66.41 $ 29,950 $ 96

260102 AMCX AMC Networks Cl A S 3906 7.68 $ 29,998 $ 1,392

260210 JBHT J B Hunt Transport S 130 229.05 $ 29,776 $ -59

260204 BG Bunge Ltd S 253 118.37 $ 29,947 $ 524

_________

$ 53,359

Grand Total (non-option trades): $ 289,204

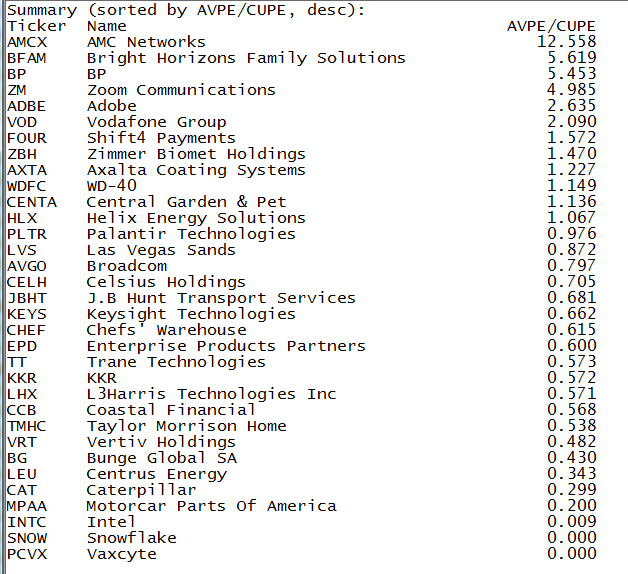

Summary (sorted by AVPE/CUPE, desc): Ticker Name AVPE/CUPE AMCX AMC Networks 12.137 BFAM Bright Horizons Family Solutions 5.721 BP BP 5.406 ZM Zoom Communications 4.948 VOD Vodafone Group 2.919 ADBE Adobe 2.629 FOUR Shift4 Payments 1.572 ZBH Zimmer Biomet Holdings 1.462 AXTA Axalta Coating Systems 1.222 CENTA Central Garden & Pet 1.156 WDFC WD-40 1.150 HLX Helix Energy Solutions 1.048 PLTR Palantir Technologies 0.978 LVS Las Vegas Sands 0.871 TMHC Taylor Morrison Home 0.830 AVGO Broadcom 0.793 CELH Celsius Holdings 0.772 JBHT J.B Hunt Transport Services 0.695 KEYS Keysight Technologies 0.673 CHEF Chefs' Warehouse 0.620 EPD Enterprise Products Partners 0.603 TT Trane Technologies 0.577 KKR KKR 0.570 LHX L3Harris Technologies Inc 0.567 CCB Coastal Financial 0.566 VRT Vertiv Holdings 0.483 BG Bunge Global SA 0.425 LEU Centrus Energy 0.334 CAT Caterpillar 0.298 MPAA Motorcar Parts Of America 0.200 INTC Intel 0.009 SNOW Snowflake 0.000 PCVX Vaxcyte 0.000This is useful in relating recent performance to past valuation.

![]()

12-08-2025: Chefs Warehouse (CHEF): Wholesale or Retail?

11-07-2025: J.B. Hunt Transport Services (JBHT): Billion Dollar Buyback

11-05-2025: Helix Energy Solutions Group (HLX): New Gulf of America Contract

11-04-2025: AMC Networks Inc. (AMCX): Declining Streaming Customer Base

10-31-2025: Zoom Communications, Inc. (ZM): Free Meeting Rooms Lead to Upscale Add-Ons

10-20-2025: Snowflake Inc. Cl A (SNOW): Understanding What They Do Is Difficult

09-12-2025: Taylor Morrison Home Corp. (TMHC): Real Estate Housing Price Cycle Peaking?

08-27-2025: Axalta Coating Systems Ltd. (AXTA: Protective Coatings are a Big Business

08-07-2025: Vodafone Group PLC ADR (VOD): Connecting the World

08-01-2025: MotorCar Parts of America (MPAA): Small Cap Heading Toward Big Cap

07-28-2025: Plantir Technologies Inc. CL A (PLTR) Another "Dot".Com Era" Lookalike?

05-25-2025: Why Most Seniors Have a Short Lifespan After 80 and 5 Secrets to Living Beyond

04-30-2025: Plan to Insulate Manipulated U.S. Markets

04-27-2025: How Fools Become World's Most Powerful Leaders

10-25-2024: W D 40 Company: Swing Tradeable?

10-19-2024: Centrus Energy, Inc. (LEU): World's Only Publicly Held Nuclear Fuels Processor

10-11-2024: Pennant Investment Corp.: 7 % Per Annum Paid Out Monthly

to make the same transactions.

No one should follow investment advice blindly. This web site should be used only as a "sounding board" for confirming one's own opinion. Any suggested order placements should

be reviewed and reset to fit current market conditions by individual traders.

![]()

![]()